Choosing the right health insurance to your small business is quite significant when it comes to providing your employees with security as also maintaining your business budget within limits. The decision can be seen as overwhelming but, through the usage of proper information, you will be in a position to select a plan that fits your budget and the interests of your employees. This is the guide in which you will manoeuvre yourself through it.

Table of Contents

ToggleThe reason why Right health insurance is important to small businesses.

Health insurance of your employees is not merely a matter of doing what the law says. It’s about:

1.The attraction of best talent: Competitive benefits are one of the ways to make you attractive as an employer.

2. Increasing employee morale: Employees who have a sense of safety in their health insurance get more involved.

3. Fewer sick days and higher productivity through care: Reduced absenteeism.

Offering medical insurance for small businesses can significantly enhance the health and well-being of your team, reducing long-term costs and improving workplace satisfaction.

Step 1: Compare the Health Insurance Plans of Your Competitors.

Your competitors are offering anything before you settle on the health insurance plan that suits you. It will be worth knowing how they go about things.

Research local business: Find out what other businesses in your locality are offering and why the employees may choose those plans.

Check Online Review: Sites such as Glassdoor can provide information on the satisfaction of the employees on health benefits.

Assess Coverage: Does it include dental, vision, or mental health coverage by its competitors? Know what you require according to industry benchmark.

Step 2: Right Health Insurance Plans of the small businesses.

Health insurance plans that can be purchased by the small businesses are of various types. Here are the most common:

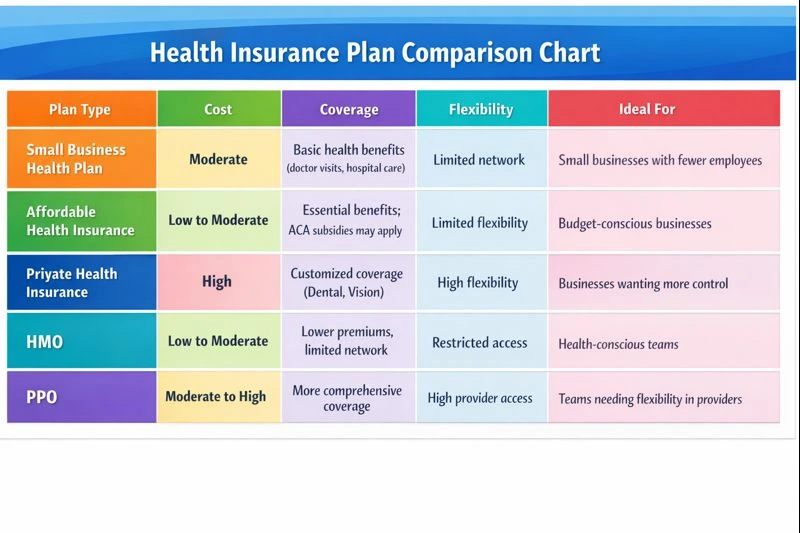

Small Business Health Insurance Plans

These plans cover clusters of employees and hence are cheaper as compared to individual plans. The most appropriate ones can have a broad set of benefits.

Plans of Affordable Health Insurance.

In case you have a budget, find cheap health insurance. ACA tends to give subsidies to reduce expenses to the small business owners.

Health insurance that are privately owned.

These plans are more customized and controlled. They are however usually costly as opposed to group plans so it is important to weigh the cost and the needs of your workers.

Step 3: Critical Factors to Keep in Mind in Selecting a Right Health Insurance Plan.

The key factors to consider when the health insurance plans are evaluated are:

Coverage Options

There are those that only take care of basic doctor visits, and hospital services, whereas others are inclusive of dental, vision, and mental care. Select the one that is most suitable to your team.

Cost

Know what the entire cost would be including the premiums, deductibles and co-pays. Group plans are cheaper in most cases, however rates may fluctuate.

Employee Preferences

Are your staff members inclined towards HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization)? Such plans provide varying degrees of flexibility of selecting doctors and specialists.

Elasticity and Access to Providers.

There are plans with a limited provider network whereas others are more flexible in having access to doctors and hospitals. In case of geographical dispersion of your employees, make sure that there are providers in different locations and this is reflected in the plan.

Tax Benefits

Think about tax-saving plans like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which can be a saving to you and your employees.

Step 4: Choosing the appropriate right health insurance plan steps.

The following is the way to select the most suitable plan to your small business:

Assess Your Business Needs

Take into account the scale of your business, the demographics of your employees and your healthcare requirements. For example, is your workforce young and healthy, or do employees have more complicated needs and are older?

Get Multiple Quotes

Compare and get quotes of different insurance companies. A health insurance broker can help you to make it easy, and go by the best plan at reasonable rates.

Check Employee Feedback

Request your employees on their healthcare preference and need. There are optional benefits that some of them might like, like dental or vision benefits.

Review the Provider Network

Determine whether the plan includes a wide network of healthcare providers, so that the employees can visit their preferred doctors, visit local hospitals.

Look over Your Budget and Get a Decision.

After evaluating all the alternatives, weigh the benefits over the cost and select the plan that suits best according to your needs and budget.

Chart: Plan Comparison of Health Insurance.

Type of Plan Cost Coverage Flexibility Ideal fit.

Step 5: Conclusion

The appropriate choice of health insurance could be crucial in the satisfaction of the employees, the productivity of the business, and its future success. As you assess your competitors, consider various plans you can have, consider both your budget and the needs of your employees, it is possible to get a plan that gives you the best coverage of your team.

You should also remember to review your health insurance plan on a yearly basis to make sure that it remains an effective solution to your changing business demands. By planning, you will be able to provide competitive advantages, as well as maintain a financially fit business.

With the information divided into smaller steps, you can be sure that you have managed the process of choosing the right health insurance to your small business. Whether you choose a small business health insurance plan, private health insurance plans, or affordable health insurance plans, the goal of Bizwellbenefits is to provide your team with quality care while balancing cost.

FAQs

What is the best health insurance for small businesses?

The optimal health insurance will be determined based on your budget and needs of employees. Group plans tend to be cheap and come with a wide coverage.

What is the best way to select health insurance to my small business?

Take into consideration the needs of your employees, your budget and coverage possibilities. Compare plans in the various providers to get the best.

Is it possible to provide small business with private health insurance?

Yes, there is no problem in providing individual health insurance plans, but it can be quite costly as compared to group plans.

Are health insurances necessary to small businesses?

The law does not mandate small businesses that employ less than 50 people to provide insurance, but it is a worthy advantage to attract talent.

What are low cost health insurance plans to small businesses?

Identify low-cost health insurance plans including those plans in the Affordable Care Act that provide fundamental coverage like group health plans.