The idea of health insurance is essential in the provision of medical cover although deciding the type of plan can be a very challenging endeavor. It is important to realize that as an individual, a family, or a business owner to get the coverage that best fits your needs, you or she must understand the distinctions between individual, family, and group health insurance. Now it is time to sink into what each of the types of insurance provides and why it is essential to individuals, families, and small businesses.

Table of Contents

Toggle1.Individual Health Insurance.

Individual health insurance is one which is provided to an individual, only to the policyholder. It is normally bought in the market or directly with an insurer. This is the best plan that a person will take when they are not covered by a group health insurance by their employer or family.

Individual Health Insurance Benefits:

Freedom: There is no necessity to rely on an insurance plan of an employer.

Portability: You will be able to carry your insurance even in case you change occupation or relocate.

But in many cases, individual plans will be more expensive and will not cover as much as group health insurance plans particularly in cases where the individual requires more medical attention.

2.Family Health Insurance:

Family health insurance is extended to cover more than a single person in a single household. This may be children, other dependents or a spouse. Similar to the individual insurance, the family plans have been offered both by the marketplace and by the private insurers.

The benefits of Family Health Insurance include:

Cost-Effective: It is frequently cheaper than the individual plans of every member of the family.

Extensive Benefit: The benefits that are offered to the families are usually broader in coverage and incorporate various medical needs, both preventive and emergency.

Shared Benefits: Families will have access to a physician network and hospitals on one plan.

The disadvantage is that family plans are usually more expensive to insure than individual ones, whereas the coverage may prove to be cheaper in the long run and therefore more appropriate in large families.

3.Group Health Insurance:

Employers usually offer group health insurance to employees, which is one of the most common forms of small business owners to cover their employees. In other instances, group plans are also extended to the families of the employees.

The benefits of Group Health Insurance:

Lower Premiums: The risk is allocated among a large number of participants; hence premiums tend to be lower than when individual plans are taken.

No Medical Exam: This is because a medical underwriting is not required in many group health insurance plans, and therefore, these are easier to secure.

Employer Contribution: The contribution that many employers are making is a substantial amount of the premiums thereby cutting down the cost that employees have to pay.

In the case of small businesses, provision of health insurance to companies is critical in attracting and maintaining employees. The health insurance plans of small business can be designed in order to fit the needs of the company and even offer health insurance to the small business owner.

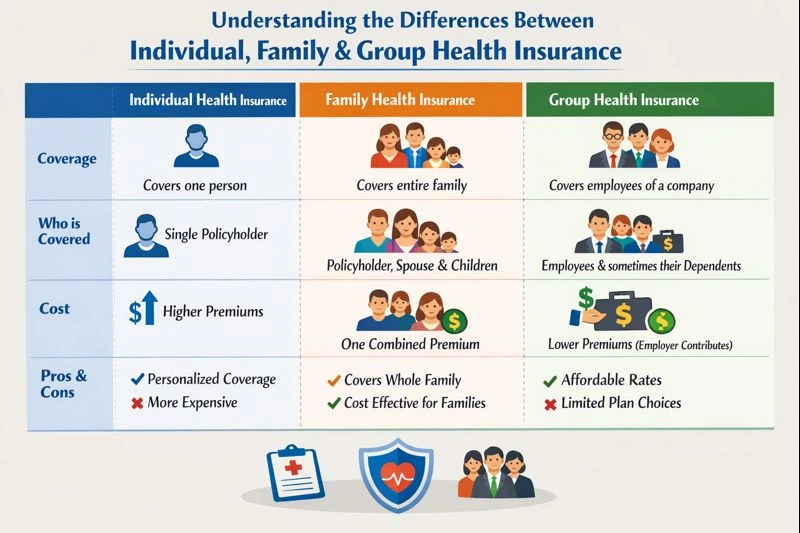

| Feature | Individual Health Insurance | Family Health Insurance | Group Health Insurance |

|---|---|---|---|

| Definition | A health insurance plan purchased by one person through the ACA Marketplace or private insurers | A single policy covering multiple family members under one plan | Employer-sponsored health insurance provided to employees |

| Coverage Scope | Covers medical expenses for one individual | Covers policyholder, spouse, and dependent children | Covers employees and often their eligible dependents |

| Eligibility | Available to US residents not covered by employer plans | Available to households with dependents | Available only through employment |

| Premium Structure | Paid fully by the individual (may qualify for ACA subsidies) | One combined premium for all family members | Premiums shared between employer and employee |

| Cost Level | Moderate to high depending on age and location | More cost-effective than separate individual plans | Usually the most affordable option |

| Customization Options | High – choice of deductibles, networks, and add-ons | Moderate – limited customization | Low – plans chosen by employer |

| Deductibles & Copays | Based on selected plan tier (Bronze, Silver, Gold, Platinum) | Shared deductibles and copays | Set by employer-selected plan |

| Coverage Limits | Entire out-of-pocket maximum applies to one person | Family out-of-pocket maximum applies | Individual and family limits apply |

| Portability | Fully portable if you move or change jobs | Fully portable | Ends when employment ends (COBRA available) |

| Claims & Administration | Managed directly with insurer | Managed by primary policyholder | Managed via employer & insurer |

| Best For | Freelancers, self-employed, early retirees | Families seeking bundled coverage | Full-time employees |

| Key Advantage | ACA subsidies & plan flexibility | Lower total cost for families | Employer contributions reduce costs |

| Main Limitation | Can be expensive without subsidies | Shared coverage limits | Limited plan choices |

How to select the correct health insurance coverage.

Comparing Individual, Family and Group Health Insurance, it is necessary to realize how this plan fits your lifestyle, pay and job position. Freelancers, self-employed professionals or individuals who are not covered by their employers tend to benefit best under individual health insurance. Family health insurance enables the spouses, or dependant children to be covered in a single cost-effective plan. Group health insurance which is mostly provided by employers is characterized by reduced premiums and cost sharing.

It can be complicated to make the correct choice even when looking at such issues as ACA compliance, deductibles, copays, and provider networks. Then professional help will come in handy. BizWell Benefits assists people, families, as well as businesses in the US to find the health insurance plans without hesitation. Be it an ACA marketplace plan or a tailor-made group health insurance, their professionals will point you to a plan that meets your health care requirements and finances. Making the right decisions is a guarantee of wisdom and eventual cold sleep.

Conclusion:

Selecting an appropriate health insurance can be a significant move in either case as an individual, a member of a family, or as a small business owner. The health insurance which covers a small business owner can vary greatly as compared to the individual or family packages, however, awareness of the difference between an individual, family and group cover can be used to make the right decision. There are always ways to consider health insurance like cost, coverage and your personal needs when choosing health insurance. When it comes to the small business health insurance, you need to think about the needs of your employees and find plans that can provide them with complete coverage and at a certain price.

FAQs

Q1: What is the distinction between family and individual health insurance?

The individual health insurance insures a single individual whereas the family health insurance insures more than one individual e.g. a spouse and children.

Q2: What is a small business group health insurance?

Group health insurance refers to a policy that is provided by the employers to take care of their employees at a reduced price as compared to individual plans.

Question 3: Do small business owners have access to health insurance cover?

Indeed, small entrepreneurs have an opportunity to take out personal health insurance or provide group insurance to themselves and their workers.

Q4: Which is the most appropriate health insurance of the small businesses?

Small businesses require the finest health insurance that relies on the size of the company, budget, and the needs of the employees. The group plans are normally cheaper than individual.

Q5: What is the process of obtaining a health insurance cover in a small business?

Small business owners are able to purchase health insurance plans via the Health Insurance Marketplace or with the assistance of private insurance brokers who provided small business health insurance options.